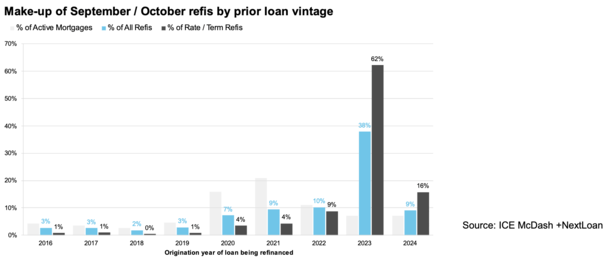

When mortgage rates fell to around 6% in August, homeowners jumped at the chance to refinance.

In the months of September and October, more than 300,000 borrowers closed on a refinance, including nearly 150,000 rate and term refinances, according to the latest Mortgage Monitor report from ICE.

This pushed refinancing volume to the highest level in more than two and a half years.

And more than a quarter of October’s mortgage lending consisted of refinancing in a market that had long been dominated by home purchase loans.

Perhaps most interestingly, borrowers who refinanced during these months saw some of the biggest rate improvements in decades.

The average refinancer achieved a mortgage rate about 120 basis points lower

You’ve probably heard the phrase marry the house, date the price. But if you haven’t, it was basically an argument to buy a home if you wanted one and hope to refinance sooner rather than later to get a better price.

In other words, the home is a keeper, but the mortgage loan is disposable. This didn’t work well in early 2022 when mortgage rates nearly tripled from 3% to 8% in late 2023, but it worked out recently.

According to ICE, the average homeowner who applied for an interest and term refinance reduced their mortgage rate by more than a full percentage point in both September (-1.07%) and October (-1.17%).

This resulted in monthly savings of $310 and $320 respectively, which is a pretty compelling reason to refinance.

At the same time, nearly a third of these borrowers were able to reduce their mortgage rates by 1.5% or more, marking one of the best periods for rate and term reductions in decades.

As you can see in the chart above, the darkest blue shaded portion (meaning a rate improvement of 1.5%+) has increased in recent months.

And the lighter shade of blue (1-1.49%) also soared, meaning it was a pretty good time to look for a lower mortgage rate.

The reason was that the 30-year fix appeared to peak at about 8% in October 2023, then fell almost two percentage points in less than a year.

The wide spread resulted in “some of the biggest rate improvements we’ve seen over the past 20 years,” according to ICE.

In fact, this mini-refi boom has only really been rivaled by the refi boom of 2020-2021 and the low-cost environment seen in 2012/2013.

So despite being short-lived, it was quite impactful for the borrowers who participated.

Most refinancers had only held their long for about 15 months

Do you ever think about how long you will actually last on your mortgage?

It’s an important question to ask yourself because it can determine whether it makes sense to pay mortgage points and/or what type of home loan you should choose.

After all, why go with a 30-year deal if you expect to sell or refinance a few years later? Why not choose an adjustable rate loan such as a 5/6 ARM or 7/6 ARM?

Of course, there’s risk involved if the price isn’t fixed and the discounts aren’t always deep, but it’s an important consideration to make rather than just going with the default option.

Yet it turns out that the average rate and term refinance guy only had their original mortgage for 15 months before refinancing.

This was the shortest period in the nearly 20 years that ICE has been tracking the metric, which tells you that people finally hit the price strategy date.

New technology warns lenders to reach out to borrowers

While it seemed like borrowers were on top of it, you might have new technology to thank for that, too.

Mortgage companies have become much better at reaching out to potential customers when mortgage rates are falling.

There are automated systems that will comb through a loan originator’s database daily, and if the rates hit a certain point, they can send correspondence to potential customers.

This may explain why such a large number of borrowers were still able to get big savings despite mortgage rates rising at the end of September.

Speaking of which, about $47 million in monthly payment savings were locked in by homeowners in September and October alone, before interest rates rose following the Fed rate cut.

I expect another refi boom to materialize soon if mortgage rates continue on their current downward path.

And chances are borrowers and borrowers alike will be ready to pounce again.