Faced with inflation, banks are providing fewer and fewer mortgages, even fewer than at the start of the coronavirus in 2020, “La Tribune” reports.

By ThePoint.fr

© Vincent VOEGTLIN / MAXPPP / PHOTOPQR/L’ALSACE/MAXPPP

Published it

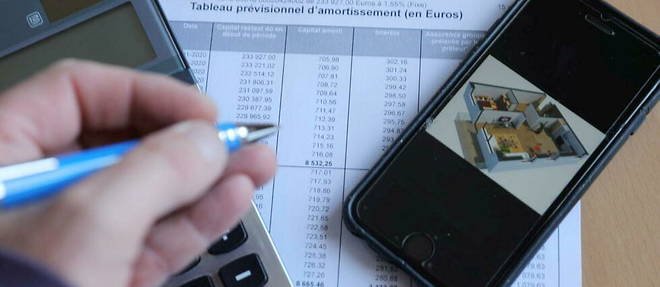

IIt is not good to want to become an owner these days. Because trying to take out a home loan is an obstacle course. Interest rates are skyrocketing and banks are increasingly hesitant to grant loans. Thus, during the months of August and September, the number of home loans signed fell by almost 35% (34.7%) over a year, according to the latest figures from the CSA Housing Credit Observatory, published on Tuesday 18 October, and shared by The gallery. It should be noted that this drop is even more significant than in 2020 during the first lockdown.

Today, if real estate loans are falling so much, it is no longer due to the coronavirus, but actually in connection with the economic situation, which, according to the CSA Housing Credit Observatory, is causing a “deterioration in the profitability of new loans” …

ALSO READCredits: prices still cheap

Indeed, a bank does not aim to underwrite mortgages at any cost and jeopardize the financial health of its customers. The goal is all the same that they are able to pay them back.

The usury rate slows down the banks

The wear rate, which is a maximum rate imposed by the Banque de France on lending institutions, is reassessed every quarter. And over the past three months, it has prevented banks from raising interest rates in the face of runaway inflation. As a result, a home loan is not profitable enough for a bank today. Hence the increase in files ending up in the “reject” box.

ALSO READReal estate: where and at what price can you find happiness elsewhere?

For the financial institutions that have chosen to continue to grant loans, a certain number of concessions had to be made. Many financial institutions ask for a larger contribution (+ 13.8%) from individuals applying for a mortgage. For example, in Paris, according to figures from the broker Cafpi, you must have a personal contribution of 150,000 euros to hope to get your loan. Finally, logically, loan terms have also evolved: more than 65% of the loans signed are granted over more than 20 years.