Lower yield

For 4 years, the companies, which manage a total of more than 1,800 billion euros in life insurance, have strived to push us, the savers, out of Euro funds (with guaranteed capital) by earning ever lower returns. Sequoia, for the record, earned less than 1.2% last year, and the market average for standard contracts “was rather in 2021 around 0.99%,” explains Cyrille Chartier-Kastler, CEO of Facts & Figures, a strategy and management consultancy. that specializes in monitoring 1,000 life insurance contracts. It was barely higher (1.30%) for legacy and high-end contracts…

also readLife insurance: how to diversify your support in the face of skyrocketing prices?

At the same time, the insurance companies encouraged us to take out “units of account”, these funds invested in the financial and stock markets, whose capital was not guaranteed. Unfortunately for them (and even more so for us savers), their advice proved disastrous with a trying stock market year (-9.5% for the CAC40 in 2022). They have decided to change course and welcome savings into their Euro funds with open arms. Better, they now increase the performance of these supports. Guilt on their part?

Keep excellent

Collection of life insurance until November 2022 (latest figures available)

It would be bad to know them: it is above all a matter of preserving their outstanding … and their financial results. Because companies fear the arrival of a tough competitor: Livret A. Its rate will be raised to 2% excluding tax from February, and this good old Livret, which has already attracted more than 400 billion euros in savings, may well divert customers from their product, the Eurofund, whose returns in 2021 had fallen to 1.3% on average, with dips to 0.80% in certain large companies. An “outflow” (when the money from new arrivals no longer compensates for the withdrawals of contracts that have expired and the settlements by transmission or inheritance) would currently be disastrous for the companies.

also readWhy Livret A remains an attractive savings product

Because we are in the phase of raising interest rates. In the event of an outflow, they would be forced to dip into their outstanding and therefore sell bonds; however, when brought to maturity, a bond is repaid at par (its original face amount). But if an outflow forces the insurer to sell it before it is reimbursed, it will only get its price in the market. And today, a large portion of these bonds (which yield less than those issued by the borrowers) are worth less than their face value on the stock market. In other words, in the event of an outflow, our insurers would be forced to sell their catastrophe bonds in the market at a discounted price, forcing them to record capital gains. Their results would suffer, their solvency constraints would increase: this is the catastrophic scenario that they want to avoid at all costs. To do this, they must retain their customers at all costs.

Orderly generosity

Suddenly it is “open bar” on funds in euros. The insurance companies (Cardif, Crédit Agricole, etc.) are again allowing 100% subscriptions in the fund in euros: they have not allowed them for three years. And above all, they raise the rate of their funds in euros to attract savings again and avoid a fall in their outstanding. “It’s on-sight piloting, where the saver doesn’t really have a say”, explains an expert in the sector. But this year we will not sulk in our pleasure … “The most generous, notes Cyrille Chartier-Kastler of Facts & Figures, are those who had earned the lowest prices in 2021.”

It is e.g. the case of Milleis, whose return on the fund in euros has more than doubled, from one year to the next, from a very meager 0.95% to a more generous 2.15%. “We welcome this trend, which allows us to better reward our policyholders in the current context”, said Patrick Thiberge, the day-to-day manager of life at the private bank, immediately. Ditto for France Mutualiste, whose contract went from 1.31% to 2.11%. This company, which targets its contracts for veterans, is particularly sensitive to the churn problem because it has a higher proportion of its policyholders who die than its competitors. Combined with a lower quota of new members, the outflow becomes a tangible risk for her, which she has fought against, in her own way…

2.50%… for the best

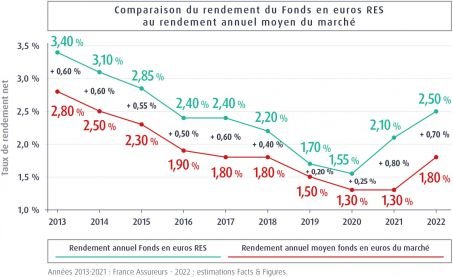

MACSF Eurofund performance compared to the average of other contracts on the market

Although the increase in their dividends is less spectacular, the number of companies that were already very generous in 2021 has also been raised. This is the case, for example, with MACSF. This investment fund aimed at healthcare professionals had already paid a good rate in 2021: 2.10%. This year it pushes it to 2.50%, making it one of the most profitable on the market for its subscribers. The mutual, which manages €27 billion in life insurance, was recently honored by the Challenges for the quality of the advice it provided to its clients. It is one of the few companies that has continued to make money in euros, as Stéphane Dessirier, its CEO, reminds us, “the security base of life insurance from which it is possible to diversify one’s investments”.

Next Thursday the 13th, Afer, the largest independent union contract with its €41.8 billion in assets, will announce its 2022 rate. Last year it was 1.70%, and you can bet the union will keep up with the market. Afer’s chairman, Gérard Bekerman, should therefore announce a return in 2022 for his guaranteed fund in euros of at least 2.50%. Less administration fees, but before social and tax deductions. This would allow this contract, like all those that have chosen a similar or higher yield, to be able to continue to perform well relative to the canonical rate (3.3% expected) of their no 1 competitor, Livret A…

.