Lately, there has been a ton of speculation surrounding the direction of mortgage interest rates.

I’ve also been participating quite a bit in this as I’ve been trying to determine what’s next for pricing.

Despite the recent increase in the 30-year fixed from around 6% to 7%, I remain bullish on them remaining in a downward trend.

Really, I haven’t changed my view since they started falling about a year ago when they seemed to peak at 8%.

Many other economists and pundits have flip-flopped since the Fed first cut interest rates in September, but that may turn out to be a mistake.

Interest rates on mortgages tend to fall before a first rate cut

The first Fed rate cut of this cycle took place on September 18, when the Federal Reserve chose to cut its federal funds rate (FFR) by 50 basis points.

This marked the “tipping point” after the Fed raised interest rates 11 times starting in early 2022 to fight inflation.

The reason they finally reversed after raising rates so much was that they felt inflation was no longer a major concern and that keeping rates higher for longer could affect employment.

Their dual mandate is price stability and maximum sustainable employment, the latter of which may suffer if monetary policy remains too restrictive.

At least that led to their first rate cut, and to everyone’s surprise, the 30-year rate rose by about a full percentage point since, as seen in the chart from MND above.

Many people believe that the Fed controls mortgage rates so that when they “cut” mortgage rates would also fall.

This is a long-standing myth, and one that has proven difficult to shake, but perhaps the recent movement in mortgage rates will finally put it to bed.

After all, the 30-year fix was around 6.125% on September 18 and quickly rose as high as 7.125% in early November.

So maybe people will stop believing that the Fed controls mortgage rates.

However, mortgage rates tend to move in the same general direction as the federal funds rate.

Why? Because even though FFR is a short-term interest rate, and the 30-year fixed rate is obviously a long-term interest rate, the Fed’s interest rate cut typically signals economic weakness ahead.

And weakness means a flight to safety, also called investment in bonds, which increases their price and lowers their yield (interest rate).

Mortgage rates responded fairly normally to the Fed rate pivot

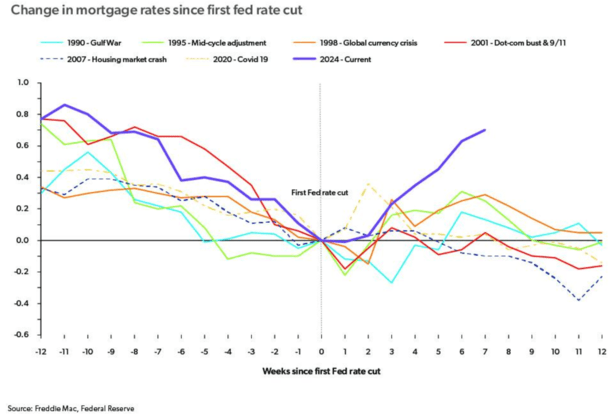

Check out this chart from Freddie Mac, which details mortgage movements 12 weeks before and 12 weeks after the first Fed rate cut.

While 2024 seems out of character when you consider that rates fell around 80 bps leading up to the cut, a rebound was not entirely unexpected.

Because a lot is baked into a Fed tapering, rates often jump a bit when the news is delivered. It’s a classic, buy the rumor, sell the news event.

Also consider that a strong jobs report was released shortly after the Fed’s policy decision, which had a big impact on interest rates.

So it also depends on what is happening at the same time. What if that jobs report was weaker than expected? Where would we be today?

In any case, there were previous instances where mortgage rates followed a similar path, including in 2020 and 1998.

In many years with a pivot, mortgage rates rose for a short period before starting to fall again.

But most importantly, mortgage rates were always falling, leading to the turning point. There has always been a pre-pivot move lower.

Simply put, mortgage rates favor the expectation of a Fed pivot, which explains why the 30-year yield fell again this year from 7.5% in May to 6.125% in September.

Will mortgage rates get back on track as they have in the past?

Using the chart above, we can see that the 30-year fixed rate remains significantly higher than it did before the Fed rate.

However, over the past few weeks (captured in the first chart), rates have fallen slightly. The 30-year peaked around 7.125% and has since fallen to around 6.875%.

So it has regained about 25 basis points of its move higher and could be expected to gain more.

It will be about 12 weeks since the Fed changed two weeks from now, so we are running out of time to get it all back.

However, history shows that mortgage rates tend to at least return to their first Fed rate levels in just three months.

And often moves even lower beyond that, if any of the other pivots seen in the past are any indication.

That’s not to say that history always repeats itself, but it would be surprising if rates don’t soon return to the low 6% ranges again, just matching levels seen in mid-September.

It also wouldn’t be a shock if they moved even lower than that over time, possibly in the high 5% range and beyond.

Again, if you look at the chart, they often continue to fall. But that will all depend on the economic data released, including the all-important jobs report on Friday.

Making matters more sinister is the incoming administration and their plans, which have put prices on a bit of a rollercoaster, and could explain why they’ve been climbing so much higher lately.

Read on: What will happen to mortgage rates during Trump’s second term?