I still hear that lower mortgage rates are the silver lining in a global trade war.

Despite the stock market and possibly much higher prices due to duties, mortgage rates are at least lower.

But how much lower are they really? And at what costs? And is there anyone who actually bites, except for recent home buyers who want to refi?

Although there is nothing wrong with looking for something positive in these challenging times, it should be noted that the rates are still not far from 7%.

In fact, the 30-year-old fasting is back to about 6.75% today!

The mortgage rates go back towards 7%

While the last week and change was big for mortgage rates, today has not started so well today.

When I pointed out a few days, big priority rates are stopped like the one we saw recently, often in their tracks without warning.

Take care of that priority rate rejection I said and that was exactly what we got today.

The 30-year-old fasting, who had fallen from 7.25% in mid-January to approx. 6.60% on Friday, is back to 6.75%.

It certainly seemed to continue to fall and probably hit 6.50% next time, but the rates jumped up again today, despite another bad day in the stock market.

Maybe bonds have not yet obtained the stock market, which is very unstable at the moment.

Maybe bonds need a respite while trying to determine President Trump’s next move.

But takeaway here is the mortgage rates are still only 25 basic points (0.25%) away from 7%, at least according to MND.

So maybe that silver lining is after all not so silver.

After enjoying a nice down -trend, it seems that priority rates have not come anywhere.

Did you know that they were actually much lower as late as October last year?

While your memory may fail you, they were. The 30-year-old fasting basically hovered about 6%.

Sure, the rates are lower than a year ago, which could increase the sale of home in the spring, but they remain closer to 7% than 6%.

And days like this make you wonder if we could visit these levels again, which would undoubtedly take the wind out of the very fragile housing market.

Mortgage lenders use any excuse to raise the priority rates

The lesson today is that Mortgage lenders use any excuse to increase priority rates.

Why? Because it is much easier to play defense, especially in uncertain times. They don’t want to be caught on the wrong side of trade.

Remember, they offer a fixed interest rate for the next 30 years. They get it wrong and it can be a costly mistake.

As such, lenders take their time to lower interest rates, but if they even get a sniff of something that increases the risk, they raise them in an instant.

Per MND jumped the 30-year-old fasting from 6.60% Friday to 6.75% today. It is a fairly significant one-day movement for their daily rate study.

Granted, the 30-year-old fell by 12 BPS Thursday, followed by an additional 3-BP feature on Friday, a total of 15 bps.

So the whole improvement of last week was essentially deleted in a single day.

That’s how it goes. You have to separate a few winning days to make progress, but one day it can completely reveal it.

These are two small steps forward and a big step back.

But wait there’s a chance that this is just a rejection

Before I get too pessimistic here and give up on the recent priority rate, I should note that this could simply be a rejection.

The stock market is doing this all the time. After a couple of down days there is a demonstration. It’s basically a breath.

Shares and mortgage rates do not move in a straight line -Up or down, especially after a big rally in one direction.

That may be what we see today. Granted, currently both shares and bond yields are lower, which is unusual.

If the stocks fall, there is typically a step into bonds, which increases their price and lowers their dividends (interest rates).

Not so at the moment. Everything sells as Trump threatens even more tariffs.

It is as if no one knows what to think and nothing is certain, not even state bonds that are typically a safe port for investors.

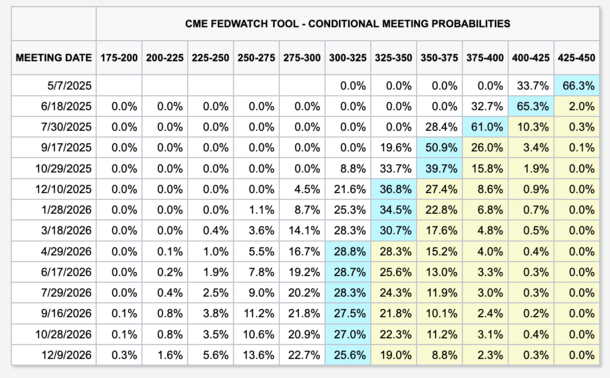

But if we zoom out, here’s one thing to consider. Fed is now expected to reduce its own federal funds four times by December, per year. CME FedWatch.

And although Fed does not set mortgage rates, bonds take signals from bold, and if you are expected to cut, you may see 10-year bond yields fall.

It tends to translate at higher prices for mortgage -supported securities (MBS) and this leads to lower mortgage rates.

So right now maybe the best time is to take a longer view instead of being caught in daily madness.

Not easy if you need to lock or flow a priority rate for the next few days or weeks, but reassuring if you want to refinance your mortgage loan in the end. Or maybe buy a home.

Read on: How to easily track priority rates.