Loan using crypto. With smart contractswas it possible to recreate on blockchains the principle of loan guaranteed by a (surplus) deposit of cryptoassets to guarantee their repayment. And this field off lending in decentralized finance (DeFi)just beat one historical record. There never has been so much outstanding loans than currently on crypto networks.

Crypto lending reaches new heights in DeFi

It is via the latest newsletter from ” On-chain Insights » from IntoTheBlock as we learn this new record for the field of decentralized financing. In fact, this team of blockchain transaction analysts has noted that users of decentralized crypto networks “ actively exploit their assets to maximize returns (dividends) thanks to sophisticated mechanisms ofloan and off strike “.

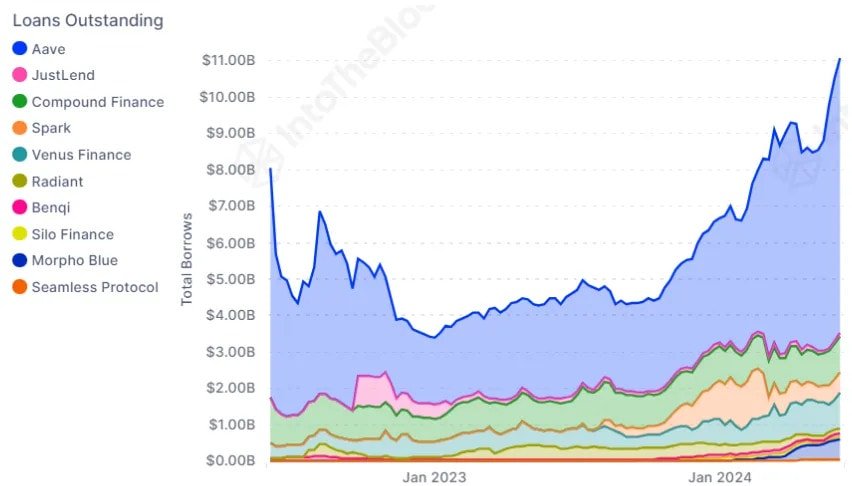

Thus loan issued by the protocols Challenge have exploded in recent months, and especially in recent weeks. Thus users of the various services of lending crypto currently has a total of 11 billion dollars outstanding loans.

A search for maximum profit, which is not without risks

In the graph above we will note that the protocolAave Labs (AAVE) is far the service of lending the most used, with a clear lead over its first competitors, Compound Finance and Venus Finance. The funds borrowed via Aaves V3 protocol thus come close 6 billion dollars.

But this strong and recent demand for loans has especially been thrust of users who do ” resumption “. That is, which uses a first protocol of liquid input to put their ethers into playEthereum (ETH) and which once again set off the tokens obtained via a protocol resumption. of ” leveraged effort »(leverage effort) to use the term used by analysts on the chain from IntoTheBlock.

However, this abundance of crypto loans is not not without danger. Loans are actually considered ” high risk »– i.e. those whose assets in reserve guarantee are less than 5% of the liquidation limit – also strong increase. According to blockchain transaction experts, these loans on the verge of liquidation would represent 1 billion dollars.

We see it clearly here, the ability to borrow in a decentralized way, without intermediaries bankers or others, is highly valued by owners of crypto assets. And in this market lendingAave development teams intend to maintain leadership, thanks V4 of their DeFi protocol.