It is a tale as old as time. Someone tries to time the market, only to fail miserably.

Then they either miss out entirely, or chase an opportunity that is no longer there, perhaps paying too much in the process.

Recently over dinner a friend told me a story that seemed worth sharing.

It involved two families selling their townhouses, but only one bought another property while the other rented.

And guess what. Almost five years later, the tenant is still renting out.

Getting the timing right is never easy, especially with real estate

The year is 2019. The housing market had seen some pretty impressive gains since bottoming out around 2012 (see this chart from the FHFA for more on that).

House prices had doubled in many markets across the country. For sellers, it seemed like a pretty good time to cash out and move on.

Of course, if you sold a primary home, you still needed new homes. That meant either renting or buying another home.

A friend of mine had her first child and was expecting her second. Like many young families, they had bought a smaller townhouse to get their feet wet.

But it was now time to find a bigger space and move from an urban area to a more suburban environment to raise their family.

The good news was that their townhouse had increased in value tremendously since they bought it.

This meant a good share of the sale proceeds and an easy sale, with low inventory and high demand for properties at the time.

It also meant finding a replacement property, which for the same reasons was no small feat.

Fortunately, they were able to land a good deal on a single-family home in a desirable area close to their in-laws in a good school district.

Meanwhile, their old neighbors who lived in the same area also sold their townhouse. But instead of buying a replacement, they chose to rent in the suburbs.

The man told my friend that he was “going to wait for house prices to come down,” given how much they had risen.

Now I don’t mistake the guy. I remember how the prices felt frothy even back then, before they went up another 50% during the pandemic.

But knocking on a price reduction and choosing to rent also came with a lot of uncertainty.

House prices rarely fall

The problem with the “wait for prices to drop” approach is that they rarely do.

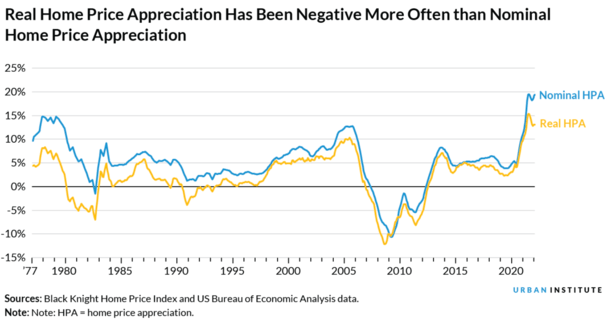

That’s not to say they never fall, but house prices are pretty sticky. There have only been a handful of times when they have fallen on a nominal (non-inflation adjusted) basis.

They fell more in real terms, but even then it has been a fairly rare occurrence. Either way, home buyers aren’t looking at home prices in real terms.

The prices they see on listings are nominal. In other words, if the price was $500,000 and is now $450,000, they will see them as decreasing.

If they were $500,000 and are now $505,000, but inflation makes $505,000 really worth something like $495,000, that doesn’t provide much relief to the potential buyer. It is still higher in their eyes.

The problem is that some people have a recent bias thanks to the mortgage crisis of the early 2000s when housing prices fell. And they think it could happen again. It can, but again, it’s not common.

Now back to the story. The guy decides to rent while my friend bought a new home. This was in 2019.

Since then, my mate’s home has increased in value by more than 50% because he got a good deal and had to work on the place.

He also got a 30-year fixed mortgage rate in the high 2s, so his monthly payment is pretty cheap even though he bought when “prices were high” in 2019.

The other guy is still renting, almost five years later. And guess what? The rent is not cheap. So it’s not like he got a major discount in the process.

You know what else isn’t cheap? Interest on mortgage loans. Or house prices. Yikes!

If the tenant buys now, he will feel he is paying too much

So the guy still renting tried to time the market. And it didn’t go well, at least with the benefit of hindsight.

There is nothing wrong with renting, but this particular family does not want to rent. They want to own a house.

Especially since they have children in local schools and want stability and peace of mind.

The problem now is that home buying has fallen even further out of reach, thanks to higher home prices and much higher mortgage rates.

For example, the $500,000 home in 2019 may be closer to $750,000 today. And the mortgage rate 6.75% instead of 3%.

That would increase the mortgage payment by about $2,200 a month, assuming a 20% down payment. Not to mention the larger down payment required.

Although he could still afford it, the guy probably has a lot of reservations when he bowed out since it was significantly cheaper to buy.

To that end, he will likely continue to time the market and wait for a better opportunity. One that may never come.

Read on: Time heals all real estate wounds if you let it