It is no secret statement for sales that has been in short supply for a long time now, making it increasingly difficult to find your dream home.

The supply of available houses fell significantly as the pandemic grabbed, but since the bottom of the beginning of 2022 it has risen by a fairly stable clip.

The obvious driving force for increased delivery for sales has been significantly higher priority rates, which has led to more homes sitting on the market.

This can mainly be attributed to a lack of affordable prices worse than conditions seen in the early 2000s housing bubble.

But there is still a broad variance in supply levels throughout the country, where the south and southeast see a glut while the supply in the midwest and the northeast remains scarce.

Available Supply Driver Housing Market

While many people believe that mortgage rates are driving home prices, that’s not really true.

Of course, there are indirect effects of higher interest rates, such as reduced purchasing power, which in turn can result in fewer buyers.

And fewer buyers mean less demand, which can increase supply if more houses sit on the market.

But if you are considering that the whole country basically has access to the same mortgage rates, it is clear that the rates are only a contributing factor.

The latest mortgage monitor report from ICE revealed that the number of active lists increased a significant 22% last year.

This pushed the national deficit of lists from -36% to -22%, which means there are still too few home for sale, but it is not as bad as it was.

In addition, we are now returning to pre-pandemic levels of sales of sales in mid-2026.

Of course, it is on a national basis and to see things nationally is not so useful for people who are considering a home purchase in a particular metro.

Housing supply is mostly back to normal in the south and southeast

Take the south and southeast, which include similar by Florida and Texas, long on the housing bear’s radar to be at risk of a home price correction.

About 25% of the larger markets are nationally already back to pre-pandemic supply levels, and most of these are located in the south and southeast.

Another 15% of markets are in the process of “normalizing” this year, which means that almost half of the United States will have sufficient supply. And right now it is mostly in the southern half of the country.

When we are part of the worst affordable prices for decades, basically at the level of Housing Bubble Peak in 2006, that can be a problem.

As noticed, conditions are already pretty insurmountable, and if more supply comes online, there is likely to be a pressure down on house prices.

On the one hand, this can be a good thing for potential home buyers in these regions.

If supply rises and sellers lower their prices, affordable prices are improved for those who want to buy a home.

But on the other hand, it means that those who want to sell cannot pick up as a high price, and this can be a problem of recent home buyers.

So much so that we could see a return of underwater loans and make assessments, something that has been uncommon for much of the last decade.

But the supply remains close in the midwest and northeast

While supply is growing in states such as Florida and Texas, it remains tight in the Midwest and northeast.

These regions continue to see limited stock, which has resulted in large housing price gains.

For example, the National Association of Realtors recently reported that the Median Prize in the Northeast ended the year at $ 478,900, which is a huge 11.8% from last year.

The same was true in the Midwest, where prices rose by 9% year-over-year.

Prices also rose in the south and West, but only by 3.4% and 6% respectively.

In other words, it remains a supply story where when noticing noted that there was only 3.3 months of supply nationally at the current monthly sales pace.

It is during your typical 4-5 months of supply to a healthy, balanced market.

But as we can see, it is not spread evenly across the country, so buying and selling conditions will vary tremendously.

There is a very bifurcated housing market today

What may be unique about today’s housing market, despite sharing the same insurmountable conditions seen in the early 2000s, the variance is across the markets.

We’ve all heard the old line, “Real estate is local.” And it couldn’t be the same today.

Some markets in Florida and Texas already have active listing counts that are above their pre-pandemic levels.

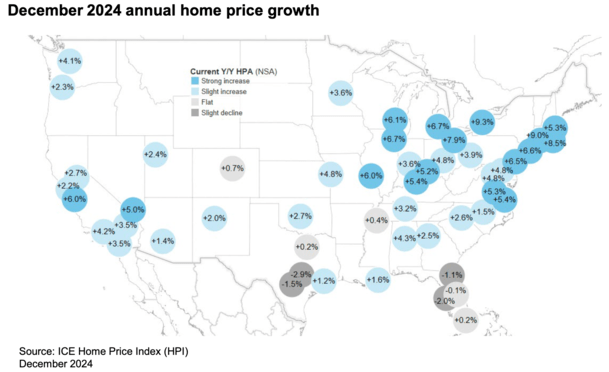

As a result, house prices have fallen on an annual basis. Large metros such as Austin, TX and Tampa, FL have already seen property values become negative.

Home prices fell 2.9% in 2024 in Austin, followed by -2.0% in Tampa, -1.5% in San Antonio, -1.1% in Jacksonville and -0.1% in Orlando, per. Ice.

Meanwhile, prices rose 9.3% in Buffalo, followed by 9% in Hartford, 8.5% in Providence and 7.9% in Cleveland and Detroit.

Long history short, it is very difficult to characterize the national housing market today as healthy or unhealthy or as expensive or cheap.

It varies significantly by market, so if you are a home buyer today (or a seller), it is imperative to know your local market and pay less attention to the national numbers.

Either way, it seems that inventory is on its way to normalization in most of the country.

Just note that even pre-pandemic levels of supply were not necessarily high, so even then the choice can remain limited.

And most importantly, without returning to fast and loose mortgage loans, any price that is softened that we see today will probably pale in comparison to what we saw back then.

Read on: Existing home sales fall to lowest levels since 1995