[DIGITAL Business Africa] – An online loan network, also called usurious loans, must be held accountable for its actions in court. The cyber crime platform says it has transferred the perpetrators of these cyber crimes.

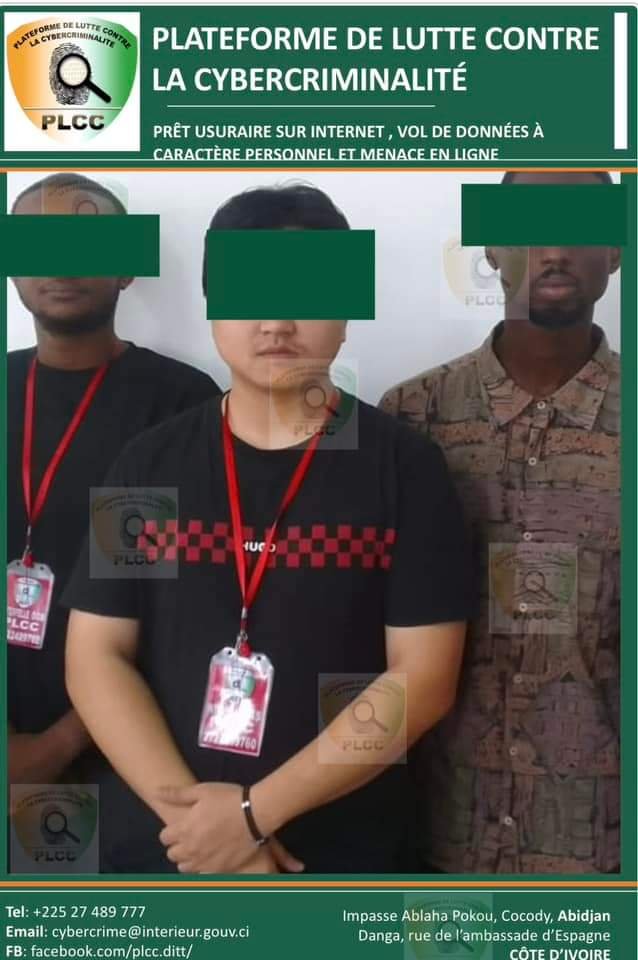

Among them an Asian. Although his nationality has not been revealed, some Ivorian netizens are convinced that he is Chinese. They would even be the brains of the operations given the cyber criminals’ modus operandi, which they say is often elaborate.

Ibrahima Blé: “I knew an Asian was behind them. Anyway, I never liked their way of doing things.”

Pénya Koné: “These people, when there is something fake somewhere, there is necessarily one in the group”.

Impressions that are not reality. But the placement in the picture (in the middle of his acolytes) seems to prove them right.

Operating mode

The network consists of several teams, each with a specific role. The first team is responsible for promoting services on social networks, promoting loans without obligations, at very low interest rates and with flexible repayment terms. This approach appeals to many borrowers, attracted by the simplicity of a loan without administrative burden. Another team helps potential customers fill the form after downloading the app and once the form is filled, money is transferred directly to the customer via Mobile Money.

Shortly after the loan is taken out, debt collectors begin calling customers incessantly demanding repayment. Those who fail to repay on time face daily interest rate increases. Lenders harass borrowers so much that some find themselves repaying double or even triple the original amount. For those who try to resist, a team accesses their phone books through an interface, harasses and threatens their loved ones to apply further pressure for repayment. These internet users were victims. They testify.

Ketia Tape: “They call everyone in your phone book. They claim you’re wanted for breach of trust.”

Nakulma Judicaël Bo: “They have already done this to me and they have access to your phone, to all the numbers you use. They contact them to tell them you have taken out a loan”

Sanctions

According to the PLCC, online loans are known for their underdeveloped interest rates and are characterized by particularly devastating financial conditions. Illegal and immoral practice. They are then blacklisted by Ivorian law. The Law on the Suppression of Usury in UEMOA’s Committee on General Affairs and Institutions, in its Article 7, provides:

“Anyone who has granted a usurious loan to another or knowingly provided, to any property and in any way, directly or indirectly, his assistance in obtaining or providing a usurious loan… In the event of a repeat offense, the maximum penalty will be increased to five years’ imprisonment and a fine of 15,000,000 CFA francs ».

The Platform for Combating Cybercrime (PLCC) was alerted to 492 complaints of usury online. Its investigations in collaboration with the Digital Criminalistics Laboratory (LCN) made it possible to identify the various digital platforms used by the network. These are OZZYMONEY, CASHARROW, CRÉDIT CORNET, JUJUMONEY, BOMPRÊT, NANACRÉD, OCEAN and MUMUARGENT.

By Jean Materne Zambo, source: PLCC