It’s that time of year when I look at what the next year may have in store for mortgage rates.

It’s never easy to accurately predict mortgage rates, and this past year was no exception.

The 30-year fixed ranged from a low of 6.08% in September to as high as 7.22% in May, and interestingly, it’s not far from the level of a year ago today.

For reference, it ended the year 2023 at 6.61% per Freddie Mac data and averaged 6.60% last week.

So what will 2025 look like? Well, that’s anyone’s guess. But let’s look at some popular forecasts (including my own) to try to make some educated predictions.

Forecasters expect mortgage rates to improve but remain high in 2025

First of all, let’s start with the general consensus, which is somewhat positive on mortgage rates in 2025.

Like last year, most industry experts and economists expect mortgage rates to ease in 2025 but remain elevated from levels seen in 2022 and earlier.

As for why, it mainly boils down to high government spending and still sticky inflation. This means the government may have to issue more debt in the form of government bonds, with increased supply hurting bond prices.

If inflation picks up again at the same time, bonds will also suffer in that way. Of course, it all depends on what actually takes place under the new administration.

I’m not entirely convinced that mortgage rates will rise during Trump’s second term, even though they initially rose during his first term.

A big reason is that they are already up about 100 basis points (1.00%) since September, when it looked like he was the frontrunner.

So his possibly inflationary policies such as widespread tariffs and tax cuts are already baked in. And if reality defies expectations, prices have room to move lower.

They could also fall if unemployment continues to rise, as that has been the Fed’s main concern, not so much inflation.

Anyway, let’s check out some estimates and go from there.

MBA 2024 Mortgage Predictions

First quarter 2025: 6.6%

Second quarter 2025: 6.5%

Third quarter 2025: 6.4%

Fourth quarter 2025: 6.4%

As always, I compile an overview of forecasts from the leading economists and housing groups.

I always like to check in to see how they did the year before, even if it’s no indication of performance for next year.

First, we have the Mortgage Bankers Association (MBA), which last year predicted a range of 6.1% to 7%.

They actually expected the 30-year to be down to around 6.10% in the fourth quarter of this year, and that might have been true if rates didn’t spike after the election.

In 2025, they play it very conservatively with a very tight range of 6.4% to 6.6%. In other words, only 20 basis points of movement.

It seems a bit too narrow to be taken too seriously, but anything is possible. Mortgage rates are pretty close to levels last seen in 2001.

And during that year, the 30-year fix ranged from 6.62% to 7.16%. So it is not out of the question.

However, recently mortgage rates have shown much more volatility and have seen a much wider range.

The one upside to this prediction is that more stability could lead to some compression of mortgage spreads, which could provide some relief.

Currently, mortgage spreads remain about 100 bps above their long-term average, meaning MBS investors demand a premium over Treasuries.

Fannie Mae 2024 mortgage predictions

First quarter 2025: 6.6%

Second quarter 2025: 6.4%

Third quarter 2025: 6.3%

Fourth quarter 2025: 6.2%

Now let’s take a look at Fannie Mae’s mortgage forecast, which, along with Freddie Mac, buys mortgages from lenders and packages them into MBS.

Last year, they expected the 30-year fix to range from 6.5% to 7% and end the year around 6.5%.

Not too far off, but it actually turned out to be too conservative. This year they are a bit more bullish and expect a slow decline back towards 6.2%.

It seems to be a pretty safe forecast, although they update it every month and I’m using their latest forecast dated December 11th.

They seem quite optimistic, but not optimistic enough to put a 5 on the board. They also expect a slow improvement over time just like the MBA.

We know that mortgage rates rarely move in a straight line up or down, so expect the usual twists and turns along the way.

Freddie Mac 2025 Mortgage Predictions

First quarter 2025: n/a

Second quarter 2025: n/a

Third quarter 2025: n/a

Fourth quarter 2025: n/a

Next up is Freddie Mac, which a few years ago stopped providing mortgage rate predictions.

They are the main source of mortgage data through their weekly Primary Mortgage Market Survey (PMMS).

But unfortunately no longer provides monthly forecasts or predictions for the coming year.

However, they do provide a monthly outlook so we can gather a little bit of information there.

Their latest edition mentions recent mortgage volatility, but says “as we enter 2025, we expect interest rates to gradually decline over the course of the year.”

So that’s a good sign, and in line with the other forecasts mentioned above.

They believe that lower mortgage rates in 2025 should also reduce some of the interest rate lock-in effect plaguing existing homeowners and free up more for sale in the housing market.

In turn, these lower prices should increase inventory and lead to a small increase in home sales next year.

Despite more inventory, they still expect home prices to continue to move higher, albeit “at a slower pace.”

Finally, they forecast that the total volume of home loans will increase “modestly in 2025” thanks to more home equity loans and increased refinancing applications tied to lower interest rates.

Many existing homeowners can benefit from interest and installment financing if rates can return to the low 6% ranges. And millions more will likely refi if rates fall to the mid-5s.

NAR 2025 Mortgage Outlook

First quarter 2025: 6.0%

Second quarter 2025: 5.9%

Third quarter 2025: 5.8%

Fourth quarter 2025: 5.8%

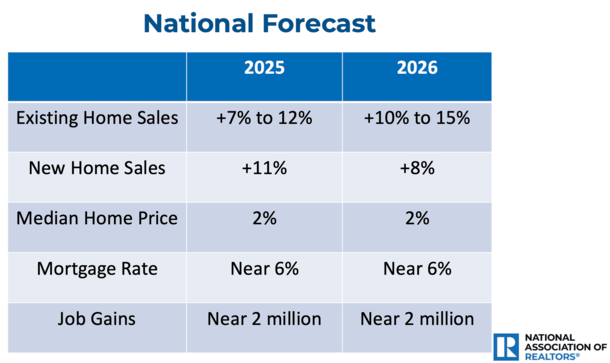

Now let’s look at the always entertaining forecast from the National Association of Realtors (NAR), which publishes a monthly US economic outlook.

This report contains their mortgage predictions for the coming year, although the latest I could track down was from October.

But I also came across a presentation by NAR Chief Economist Lawrence Yun who simply said that mortgage rates will be “close to 6%” for both 2025 and 2026.

In any case, both forecasts are quite bullish, as they always tend to be. The real estate group rarely predicts higher rates and often expects improvements in the coming year.

And it is therefore no different from previous years. They expect the 30-year fixed rate to slide lower and lower, even going below 6%.

Last year they expected rates to range from 7.5% in the first quarter to 6.3% around now. It turned out not to be too far off.

Wells Fargo 2025 Mortgage Rate Forecast

First quarter 2025: 6.65%

Second quarter 2025: 6.45%

Third quarter 2025: 6.25%

Fourth quarter 2025: 6.30%

Former top lender Wells Fargo also releases a US economic forecast with all types of estimates for both 2025 and 2026.

They also go with estimates that mirror Fannie Mae’s and MBA’s mid-to-low 6s.

What’s interesting about their forecast is that they have 30-year fixed rates bottoming out in the third quarter of 2025 before rising in the fourth quarter.

Then it goes up a bit more in 2026. So according to them, 2025 may be as good as it gets for a while.

Granted, it all seems to be based on the trajectory of the 10-year bond yield, which they also see bottoming in Q3 2025.

Predictions from Zillow, Redfin, Realtors and the rest

There are a lot of predictions out there and I want to keep this article a little short, so let’s discuss a few more before I share my own.

Zillow has said it expects mortgage rates “to ease but remain volatile.” In other words, they will probably get better in 2025, but experience the typical ups and downs.

And they rightly point out that this volatility will present risks and opportunities, so be wary.

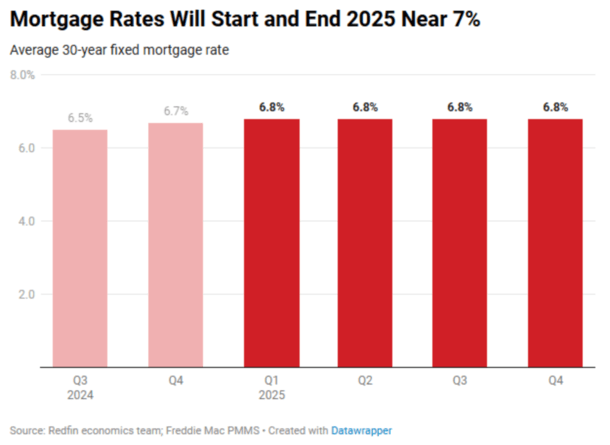

Redfin is quite pessimistic, saying that mortgage rates are likely to start and end 2025 around 7%, with an average of around 6.8%.

They base it on Trump’s tariffs and tax cuts and continued economic strength. But they throw out an alternative theory where rates fall into the low 6s if the expected scenarios don’t play out.

At Realtor, which is owned by News Corp. and licensed by NAR, they expect a lower average of 6.3% in 2025, with rates ending the year at around 6.2%.

They also adjusted their mortgage forecast upward to reflect increased government spending and higher prices/inflation due to tariffs and lower taxes under a Trump administration and Republican-led Congress.

But just as the others are unsure whether and what will actually become something, since speeches, words, proposals and reality are very different things.

The National Association of Home Builders (NAHB) also weighed in via their monthly Macro Economic Outlook.

They expect the 30-year to fall to 6.36% in 2025 from 6.73% in 2024, about a 40 basis point improvement.

Mortgage interest rates are top of mind for builders who have gained a lot of market share recently as the existing supply suffers from mortgage lock-in.

Their interest buybacks have penciled in deals for the past few years, but come at a big price for the developer.

And finally, First American economists expect mortgage rates to fall between 6% and 6.5% during 2025.

The Truth’s 2025 Mortgage Rate Prediction

First quarter 2025: 6.5%

Second quarter 2025: 6.75%

Third quarter 2025: 6.25%

Fourth quarter 2025: 5.875%

Okay, now it’s my turn. I know mortgage rate predictions are for the birds, but it’s still worth throwing out there.

Last year I was quite bullish, expecting a 30-year fixed at 6.25% in the third quarter and 5.875% in the fourth quarter of 2024.

I was mostly right about the third quarter, but I failed to account for the presidential election, which threw off my prediction for the fourth quarter.

Still, I take responsibility, and unlike the other predictions, I will make adjustments going forward so that my forecasts are less linear throughout the year.

In other words, not just lower and lower as the year progresses. It is too obviously wrong.

That said, I expect an average rate of 6.5% in the first quarter as the recent rate hike doesn’t feel justified. So a simple emergency meeting into the new year.

Then an increase in the second quarter, as mortgage rates always seem to be at their highest in the spring, when homebuyers need them the most.

But only worsened by about a quarter of a percent, before falling again in the third quarter due to economic weakness and rising unemployment.

And finally slip below 6% in the fourth quarter, but only just below 6%.

The basic premise for me is that I see a weakening of the economy and don’t believe that all of Trump’s policies will come to fruition, which are probably already incorporated into higher rates.

For the record, I wouldn’t be surprised to see rates hit the high 5s in select weeks in other quarters as well.

So, as always, there will be plenty of options for both home buyers and existing home owners looking to refinance. Just keep your eye on the ball!

Read on: How are mortgage interest rates determined?