Released

Vehicle insurance“Sooner or later, every insurance company will adjust its premium”

A sharp increase in the price of spare parts and violent hailstorms in recent years have led to an increase in insurance premiums.

Some have already seen their car insurance premium increase for 2023.

Wayhomestudio Freepik

As the holidays approach, it’s time to take stock. Between gas price increaseof electricity or house rents, the bills promise to be steep from 2023. And motorists are not cutting it either. “My premium goes from 693 fr. 50 to 856 fr. 20 at once!” is insulted this December by a pensioner from Vaud whose vehicle is insured by Simpego.

To justify this increase of more than 20%, said insurance in a recent letter cites “the sharp increase in the price of spare parts for vehicles and unusually violent hailstorms this year and last year”. An “adjustment of tariffs to current and future conditions”, she adds.

All placed in the same boat

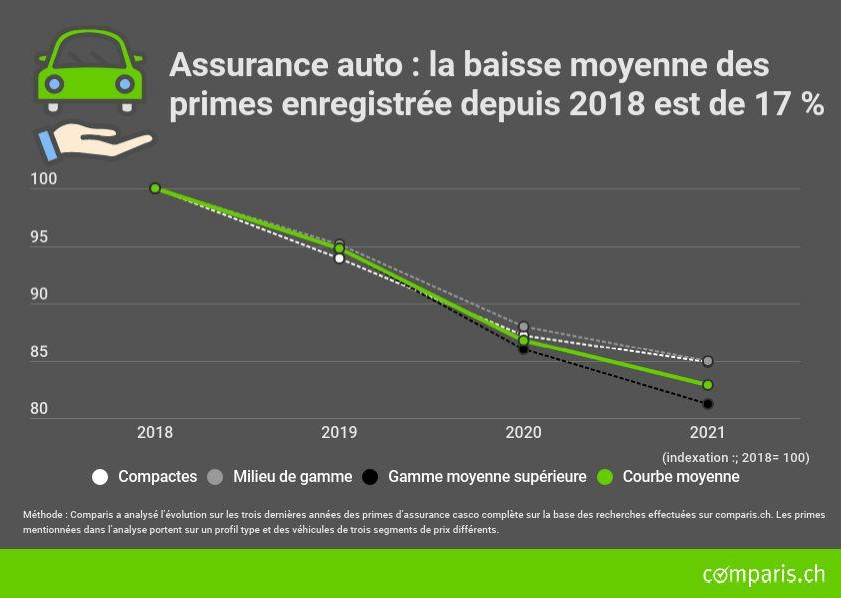

And this case is not isolated. “Sooner or later, every insurance will adjust its premium,” confirms the Swiss Transport and Environment Association (ATE), which states that the branch had not experienced an increase in this order for more than ten years. If it does not give examples of insurers who have already raised premiums, ATE reports that the number of motorists who have complained about it is “very moderate”.

The association reminds, “that in the event of tariff regulation, the customer has the right to terminate his contract until the end of the current insurance year. It is possible to request a new offer from a provider.” ATE advises those concerned to carefully compare the services before entering into a contract.