For mortgage loans across the country, it is an old -fashioned question: “Lock or flow?”

It is a question of quiet loans and mortgage brokers are asked on a daily basis, often over and over again by paniced borrowers and first -time home buyers.

And this is perhaps just the most important answer you come up with during the loan process as it will determine the priority rate you will eventually receive and possibly last for years.

The interest rate you choose dictates what you pay each month for potentially for the next 30 years (assuming you are not refinancing), so it is not a decision to be made easy!

How locking vs. fluently a priority rate works

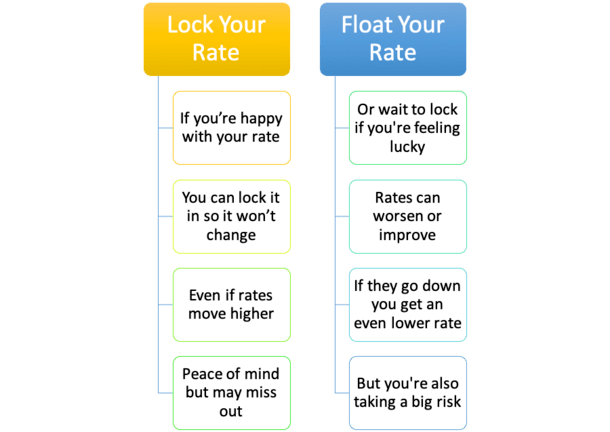

- You will have the opportunity to lock or flow your interest rate when applying for a priority loan

- If you lock, the interest does not change as long as you finance your loan before the expiry

- If you float, the rates can go up or down until you finally lock it in

- Your loan officer or broker may be able to advise you on what movement to make

When you submit an application for a home loan, you will be asked if you want to lock your priority rate or flow the rate.

If you choose to lock the interest rate, you guarantee yourself some interest on your priority loan.

So if the lender says you can lock an interest rate of 6.25% on your 30-year fixed rate priority loan today and you are happy with it, they can lock it in for you.

This ensures that your rate does not change even if the mortgage rates rise higher during the days and weeks after you have locked.

At the same time, this means that you cannot benefit from a lower priority rate, provided they are falling even more as your loan closure date is approaching.

Note that locks come with expiry date, such as 15 days, 30 days, and so on. So you need to finance your loan before this date.

Conversely, if you choose to flow your rate, you essentially tell the lender that you do not like where the rates are and want to endure for better.

Or it might just be that your loan approval is still a month away and you don’t want to lock too soon and have to pay to extend your lock if it takes longer than expected to close.

Either way, Your priority rate can always be changed until it is locked.

[Do mortgage rates change daily?]

Locks or floats? Do you feel lucky?

- To float a priority rate is in itself risky because no one knows what tomorrow is holding

- It can be a dangerous game to play if you can’t afford a higher interest rate

- But you can potentially settle with a lower priority rate if you choose to wait

- A tip is the more time you have until you close, the greater your chances of ensuring a lower rate

When deciding to lock and flow, assess your situation. Each borrower has a unique story and every day is different, so there is no hard and fast rule here.

Some borrowers may not be comfortable with “letting it ride.” While others may be market experts and have a good grip towards mortgage rates.

Generally, What is bad for the economy is good for mortgage ratesWhich explains why they are so darn high at the moment. High inflation has caused the mortgage rates to rise.

If you prefer to sleep at night and “like” where mortgage rates are right now, locking may fit you better than flowing.

And if you think mortgage rates don’t get much better, it is likely to lock that locking is the move.

If you cannot risk taking on a higher priority rate (think a DTI ratio on the brim), it would be very smart to lock your rate to avoid future hiccups or a refused loan application.

You can choose to flow your priority rate if you can absorb a higher payment

On the other hand, if you think mortgage rates have room to fall before loan, you can choose to flow your rate.

After all, 30-year-old fixed priority rates rose as high as 8% and have since registered a decent withdrawal. And they could fall even more if the trend continues.

So why not wait a little longer if you have time?

Instead of locking a rate of 7% on a 30-year-old corrected today, you may be able to take advantage of all the uncertainty going on (shaky economy, in-depth feed with fed, etc.) and wait for your rate to fall to say 6.5% or lower.

If that happens, you save money each month through a lower mortgage payment and much more during the life of the loan.

Even if the rates are not significantly improved, you may be able to hang a larger lender credit to offset your closure costs if pricing becomes somewhat better.

Just be aware of that You take a chance. And you only have so much time before you have to lock your rate to initiate the loan finishing process.

Prices could deteriorate significantly, raising your monthly payment and your DTI ratio. This can even jeopardize your application completely. So make sure you can absorb pricing of worst-case.

Tip: How to track priority rates.

A mortgage loan that flows can also be an option

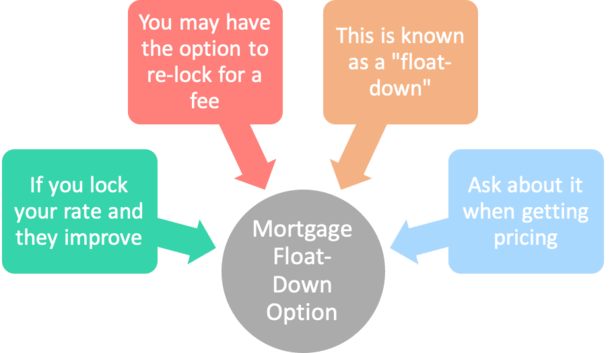

- A float-down can also be an option with some banks and mortgages

- It allows you to lower your already enclosed interest rate against a smaller fee

- The option comes into force if the rates fall significantly when you have locked your rate in

- At that time you may have the opportunity to lock back to the lower rate despite the fact that you previously locked your loan

Apart from liquid and locking, you may also have the opportunity to “float down” your rate. Be sure to ask your broker or loan manager about their floating policy when you ask for pricing.

A float-down is an option that becomes available when you lock your clean to take advantage of potential interest rate improvements after fact.

It’s a bit like an insurance policy for your interest lock if the rates get even better.

For example, you should say that mortgage rates fall dramatically after you lock. Go figure!

If they do, you may have the disposable option to flow the rate down to the current levels for a small price.

This allows you to take advantage of the interest rate fall if you want an even lower rate, despite the fact that you are already locked in on an earlier date.

However, as mentioned, there is often a cost to the flow and it can be quite significant. There is also no warranty that will be improved when you lock.

The cost of a flow will vary from bank to the lender and be able to run anywhere from .125% to .375% of the loan amount (or higher) to take advantage of the current pricing.

So for higher loan amounts, says on a jumbo home loan, it can be a costly option.

However, you still need to get out in front, even when you factoring in advance costs thanks to the lower interest rate.

Just make sure you stay in the home (or keep the mortgage loan) long enough to recover the fee.

Other locks/float considerations

- Ask what your lender is Float -Down -politics before locking

- Their policy can act as a kind of cover for your decision

- Ask how long the locking period is (eg 15 days, 30 days, 45 days, etc.)

- Think about how long you hold the property and the mortgage loan

- If sales/refinancing soon may flow be a more acceptable strategy

- Track market conditions (MBS prices, 10-year bond yield) to determine if it is in your best interest to lock or flow

Not all lenders have the same float -down policy. In fact, some might not even offer one. Or it can be less attractive than others out there.

Some lenders may offer to divide the difference with you if the rates fall significantly after locking.

For example, if the rates are 0.25% lower than when you originally locked, they can lower your rate by 0.125% as a courtesy free.

Others can renegotiate the lock (Rate Lock Break) just to keep your business if the rates have really fallen, so it never hurts to try to fight a little if it happens.

Just remember that lenders generally have restrictions on when you can perform a flow where low speed can/should fall and how long the lock can be expanded (if at all).

The Float-Down setting can usually only be used once, and it must occur before the lock expires, often within a specified period of time before the loan is set to close.

If you buy a home or build a (new building), you may get an extended speed lock option with a built-in float-down option, sometimes referred to as “Lock and Shop.”

Some lenders also offer free float-downs, as is the case with Quicken Loan’s Rateshield approval, which allows you to lock into your rate before finding a home.

Once you have found a property, they give you the lower rate automatically if the rates are improved as you locked. That’s their way of securing your business in advance.

Whatever option you choose, be sure that you understand the consequences of both locking and flowing a priority rate.

Comparison of locking vs. liquid

| Locking | Liquid | |

| Rate is … | Guaranteed until the lock expired | Subject to change daily until it is locked |

| Risks | No risk of increase but could miss improvements | Can go up or down until you lock |

| Flexibility | May be able to flow down if prices are improved | Can lock when you want up until loan documents are drawn |

| Best for … | Those who are satisfied with the rate and cannot risk a higher rate due to DTI limits | Those who can absorb higher rate or believe that the rates are falling and have time to wait |

Locking vs. Liquid FAQ

What is the difference between locking and flowing a priority rate?

In short, locking means that your rate is guaranteed if you close at the expiry date of the lock. Fluent means that your rate can be changed until they are locked inside.

When should I lock my priority rate?

There is no universal answer and no one knows the future, but a general rule of thumb is to lock if you are satisfied with the rate offered and do not expect it to be much better before you close.

What is the risk of flowing my priority rate?

In short, the rate can rise and not go back before you close, saddle you at a higher rate on your loan until you refinance or sell the property.

How long does a speed lock last?

They can range from 7 days to 365 days, although regular locking periods are 15-45 days, with 30 days perhaps the most common. This coincides with the time it takes to finance a mortgage loan.

Can I change my mind after locking or floating?

If you lock yourself, no, your rate is locked, but as mentioned, a float-down may allow you to improve your locked rate. If you float, you have not yet made your mind and can freely change it!

Tip: Most lenders are likely to fail on the side of locking your rate because they do not want to explain why the mortgage rates were moving louder if they happen to get worse as they flow. But it is ultimately your decision to make!