Posted January 31, 2023, 4:11 p.mUpdated on January 31, 2023 at 16.14.

Now is not the time to blame actuaries for doing calculations with twice as many numbers. Moody’s Investors Service report on European insurance in 2023 still invites us to distinguish between the outlook for non-life business, “negative”, and the outlook for life, “stable”.

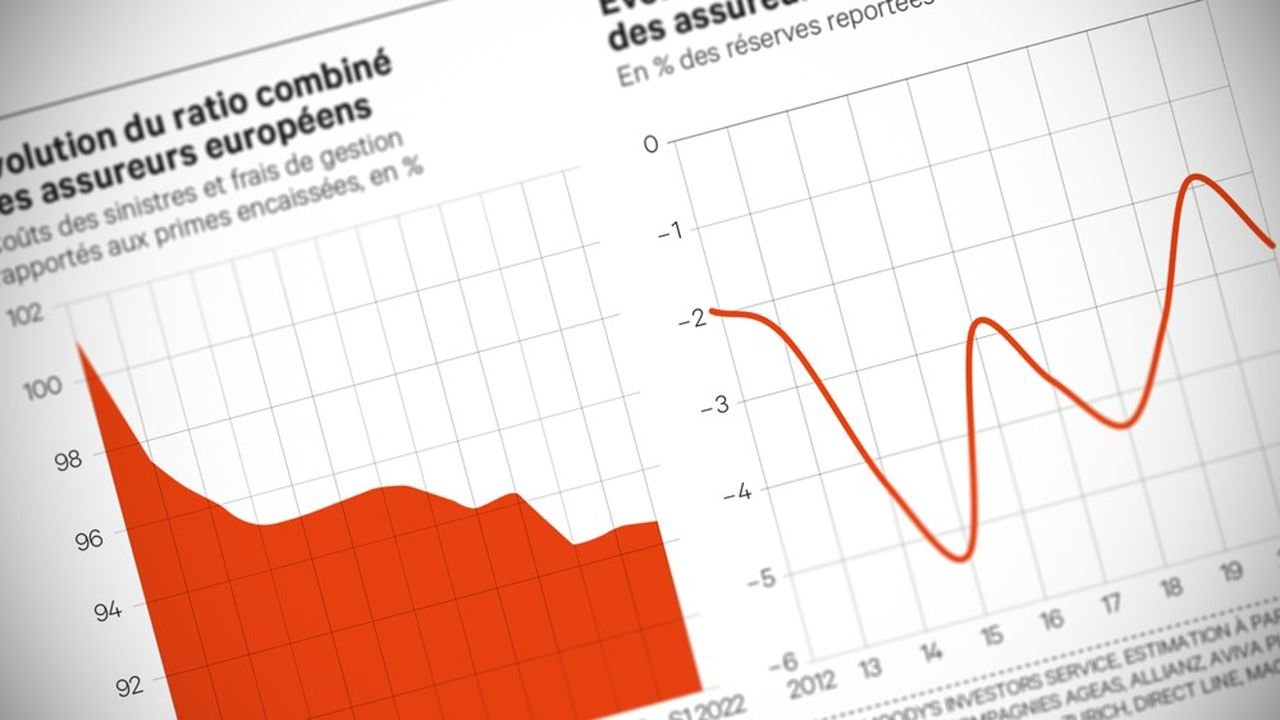

Rising interest rates benefit both, but inflation increases the repairs of the former. Its key indicator of insurance profitability _the “combined ratio”, equal to claims and expenses divided by premiums_ emerges from a decade of operational improvements, helped by adjustments to reserves in light of liabilities.

They swung into negative territory, as calculated by the rating agency. However, if inflation proves to be persistent, it will be necessary to increase them rather than release them, especially because of the civil liability.

To note

Weak economic growth, natural disasters and rising reinsurance prices are further obstacles for non-life insurers. Intense competition does not help their pricing in many countries.

What keys to adapt in a complex environment?

How do you respond to the challenges of the energy transition? How do you position yourself in an unstable economic and political environment? How can the innovation opportunities in each sector be best exploited? On a daily basis, through our decryptions, investigations, chronicles, international press reviews and editorials, we support our subscribers by giving them the keys to adapt to a complex environment.

I discover the offers