comparis.ch AG

A document

- 20221219_MM_KK-Wechsler_DA.pdf

PDF – 203 KB

Press release

Representative survey on changes to health insurance

Every fourth adult changed their basic insurance for the year 2023

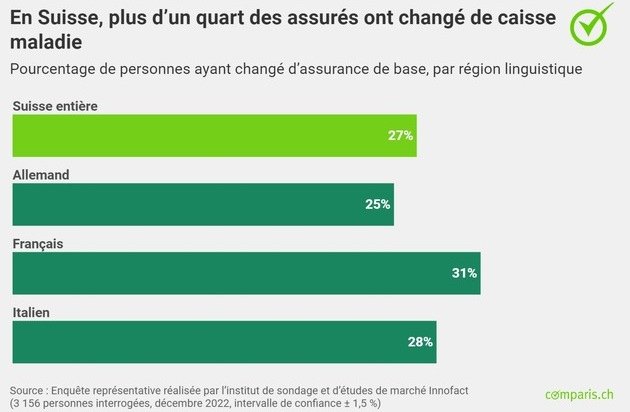

In 2023, basic insurance premiums will increase by an average of 6.6 per cent. The increase in prices triggered a massive movement of fund switching: One in four adults changed their health fund in the new year. This is confirmed by a representative survey by comparis.ch. The Romans were especially prone to change. Proportionally, a particularly high number of people who changed health insurance went from Assura and Atupri to KPT.

Zurich, December 22, 2022 – The sharp increases in basic insurance premiums, which will average 6.6% in 2023, have affected the Swiss, who are usually reluctant to switch funds. For years, the percentage of people switching health insurance was in the single digits. This year, almost one in four adults (confidence interval 25 to 28%) chose to change providers for their basic insurance. This is shown by a representative study carried out by comparis.ch, the online comparator.

Young people, men and French-speaking people are most likely to change

Those under 36 are the most likely to change, representing a 41% share. In the same way, it is significantly more likely that men than women have changed funds (32% versus 21%).

For 2023, the Roma were much more likely to change their basic insurance (31%) than the German-speaking Swiss (25%). In Ticino, 18% switched funds.

“The higher the premiums, the more the insured switch health insurance. According to our representative survey, more than a quarter of adult policyholders will be insured with another health insurance company next year, which surprises me. My forecast after the announcement of the 2022 premiums by Federal Councilor Berset exceeded 13%. Inflation has probably further increased the propensity to save,” explains Felix Schneuwly, health insurance expert at Comparis.

Rising premiums are the main argument for change

The sharp increase in premiums was by far the most important motivation for a change in health insurance. 61% of people who wanted to switch funds rated this strong increase as an important or very important factor. 47% of people who wanted to switch funds said they switched regularly. For 44% of people who switched, the poor service provided by the old fund was an important motivating factor for the switch. It is mainly the body that has been changed. 69% of customers who switched funds kept their excess with the new insurer. 62% did not change models at the time of the change.

“The fact that almost half of people who have changed funds are not satisfied with the quality of service in their old fund shows that lower premiums than those of competitors are not enough to remain competitive. The high percentage of policyholders who only switch funds, but not excess or alternative insurance model, shows that many of them were no longer saving money in their old fund,” explains Schneuwly. The arguments also emphasize the importance of freedom of choice for policyholders. “It is only when there is more than one insurance fund that dissatisfied people have the option of turning to another insurance company,” explains Schneuwly.

Relatively largest transfer from Assura and Atupri to KPT

Of the 3,156 respondents in all regions of Switzerland, 843 have changed basic insurance for 2023. This is therefore proportionally the largest transfer from Assura and Atupri to KPT. A significant number of people also switched health insurance from Visana to Helsana. Of all credit unions, KPT emerges as the biggest winner in terms of customer growth.

“Apart from KPT, which will have around 40% more customers in 2023, it is especially the small insurance companies with moderate premium increases that have attracted many new customers. It’s a surprise. In fact, over the last few years it has been the big caisses that have tended to gain customers and the small ones to lose them. Since every insurance company must build up reserves for new customers, a massive increase in the customer base entails the risk of an insufficient solvency ratio for the coming year. If an insurance company in certain cantons offers lower premiums than its competitors and can thus benefit from strong growth, the FOPH has two options. He may not approve the premiums, or he may approve them and then have to order a premium increase in the following year. After an increase in premiums during the year, most new customers leave immediately,” explains the Comparis expert.

Method

The representative survey was conducted by the polling and market research institute Innofact on behalf of comparis.ch in December 2022 among a sample of 3,156 people from all regions of Switzerland. 843 of them indicated that they would change the basic insurance for 2023.

For more information :

Felix Schneuwly Expert Assurance maladie Téléphone : 079 600 19 12 E-Mail : media@comparis.ch comparis.ch

About comparis.ch

With more than 80 million visits per year, comparis.ch is one of the most visited websites in Switzerland. The company compares prices and services from health insurers, insurance companies, banks and telecom operators. It also presents the largest online offer in Switzerland for cars and real estate. With its detailed comparisons and in-depth analysis, it contributes to more transparency in the market. comparis.ch thus strengthens consumers’ expertise in decision-making. The company was founded in 1996 by economist Richard Eisler and now has more than 200 employees.

.