The annual statistical report fromThe Supervisory Control and Settlement Authority (ACPR), supervisory body integrated in Bank of Franceconstitutes a reference document that presents the most important figures for the French banking and insurance market. It covers and summarizes the main supervisory and accounting data collected from banking institutions and insurance organizations under the authority’s supervision.

A strong financial system

The year 2021 was marked by a strong economic recovery, strongly supported by the measures taken by public authorities and central banks. In this lively context, the French financial sector, banks and insurance companies achieved excellent results and increased its resilience in financing the economy. In the first half of 2022, the situation of banks and insurance companies followed in the wake of 2021, which should enable them to cope with the outlook for economic activity, which is currently more deteriorated.

The banking sector continues to grow

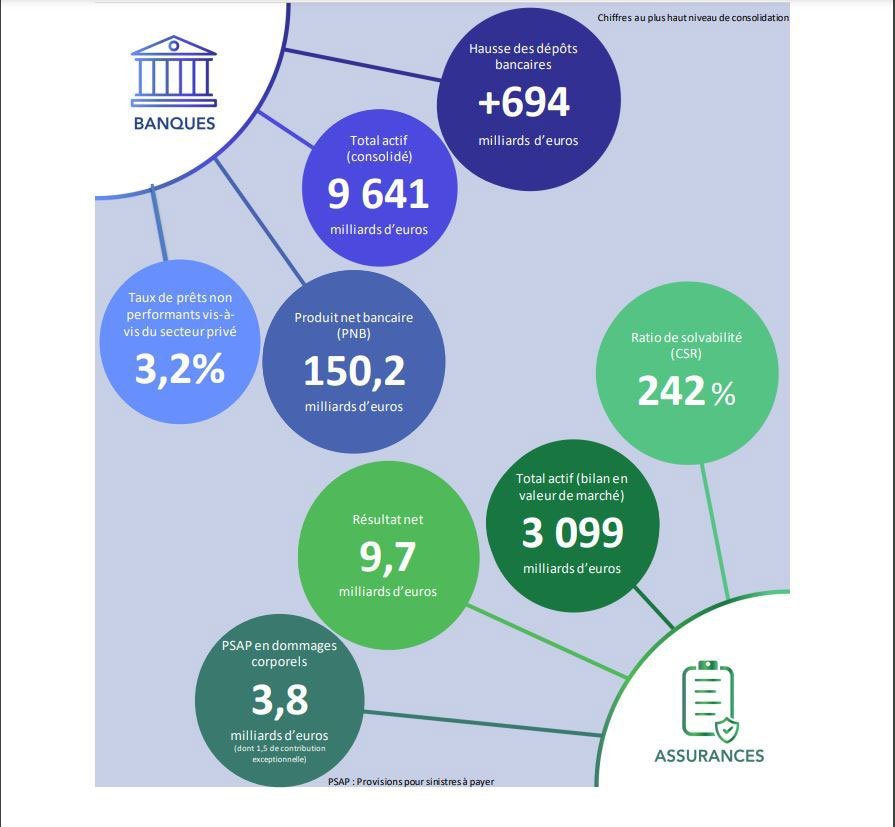

In 2021, the French banking sector saw its total assets increase by 3% reach 9.934 billion euros on a consolidated level at the end of the year. The net banking income (GDP) of French banking sector progressed rapidly, to settle at 164.2 billion euros (+9.4% compared to 2020), under the joint effect of the improvement in companies’ revenues and the controlled increase in their operating costs. The prudential situation of the banking system, which is already solid, has been strengthened: thus the overall solvency ratio of French banks stood at 16.3% at the end of 2021, slightly up on 2020 (16.1%).

Banks continued to assume their role in financing the economy, allowing the credit market to remain dynamic: +6.1% growth in loans to SMEs (on a consolidated basis) and +6.7% for housing loans to resident households (on a social basis) . In addition, credit in France continues to grow faster than the economy, as well as corporate and household debt.

Finally, the report underlines the “large economic weight at national, European and global level” of the banking sector, of which the first six groups account for 82% of the balance sheet total of the sector as a whole.

Insurance: growing business and consolidated solvency

The activity and results recorded in 2021 in the insurance sector have increased significantly. In fact, French insurers have seen theirs net premiums increase by +16% and exceed their level before the health crisis. life insurancein particular experienced a strong recovery and benefited from a lively market environment, abundant private savings and the economic recovery. In this context, unit-linked media recorded an unprecedented amount of annual inflows (30.6 billion) and now represent 44% of gross inflows per redeemable supports. That solvency of the entire sector increased by 11 points compared to 2020 to 253%. Finally, in 2021, France consolidated its position as the leading insurance market in Europe with total assessment of French insurance companies of 3.156 billion euros.

The resilience of the financial sector to the current macroeconomic and geopolitical context

Due to its very solid solvency and liquidity levels, the French banking and insurance sector was able to meet the new macroeconomic environment affected by the increase in inflation and interestas well as by the Russian invasion in Ukraine. The consequences of the latter in terms of financial stability are still limited. The French financial sector’s direct exposures to Russian assetss represent less than 1% of the total international obligations for French banks, while investments of French insurance companies in Russian securities amounts to less than 500 million euros, or 0.02% of their total exposure after transparency. On the liability side of their balance sheets, French insurers are also poorly exposed and their liabilities in sectors directly affected by the conflict are limited.

The consequences of market movements have therefore currently been well controlled by the French financial sector.

“The results for 2021 and the first half of 2022 further confirm the resilience of the French financial system, characterized by solid solvency keys, in the current context characterized by the war in Ukraine, inflation and rising interest rates. Faced with the resurgence of risks, the ACPR remains vigilant and will continue in 2022 to regularly monitor banks and insurance companies to ensure the soundness of the financial system. “, commented Dominique LaboreixSecretary General of ACPR.