By Manon Reinhardt

Published it

See my news

Living under the Côte d’Azur sun, yes, but at what cost? If real estate prices explode, those practiced by insurance seem equally worrying. In Nice (Alpes-Maritimes) it is particularly important price differences was seen compared to other major cities in France.

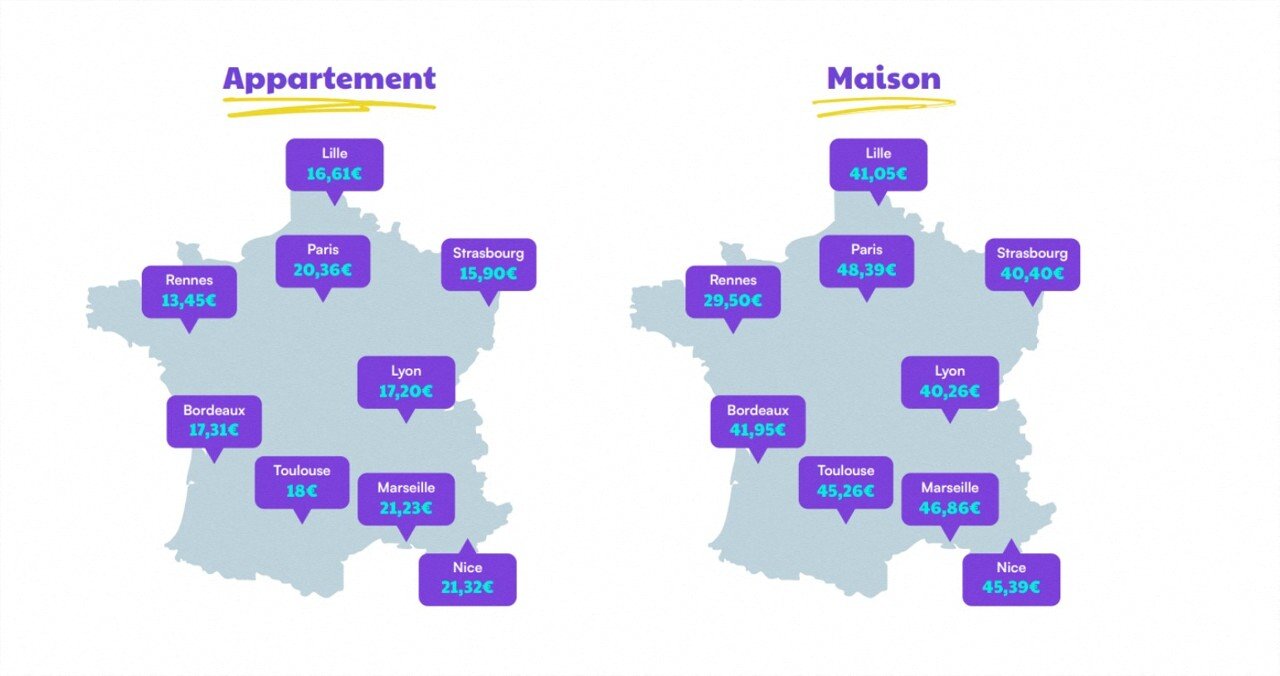

At least this is revealed by a study carried out by Leocare, the first multi-service neo-insurance, which compared home insurance prices with equal criteria, in 9 major cities (Paris, Bordeaux, Lille, Marseille, Nice, Lyon, Rennes, Strasbourg and Toulouse). And surprise, the capital of the Côte d’Azur obtains the medal for the most expensive municipality for apartments! Explanations.

A study based on 540 insurance offers

The analysis has been carried out on the basis of the offered prices per 540 insurance offers established between November and December 2022, with an area of 60 m² for an apartment, 100 m² for a house. Two formulas were considered: “eco” and “premium”. The policyholders all had a property capital of between 6,000 and 75,000 euros.

According to this study, for a 4-room house, the population of Nice (two parents and one child) spends on average €45.39 per month for their home insurance when Rennais will pay 15 euros less. Regarding apartments, the same observation: Nice is still the city where the prices are the highest. It is necessary to count €21.32 per month to insure a 2-bedroom apartment for €17.20 in Lyon or €15.90 in Strasbourg.

Almost 40 euros difference for the same contract

In its study published on Monday, January 2, 2023, Leocare compares the insurance offer, the premium formula, between Bordeaux and Nice for a one-bedroom apartment, in an unfurnished main residence and on the top floor. And the gap is crazy : 9.09 euros in Bordeaux, 48.25 euros in Nice, i.e. 5 times more for the same criteria. The average price was set at 21.99 euros for this type of contract.

These differences can be explained by a high risk of burglary to which homes are exposed. “Regardless of the cities in question, the number of burglaries has always had a strong impact on insurance prices,” notes Leocare in its study. However, the fifth largest city in France is not among the most robbed cities.

“Nice is a city that combines bad weather”

Because what causes the bill to rise in Nice is first and foremost the risk of natural disasters. “Nice was hit in 2015 and then in 2020 with the storm Alex,” says Christophe Dandois, founder of Leocare. The insurance company automatically checks recurrence of wind, floods and droughts. It is a city that combines bad weather with a greater volume. Drought will also have an impact on the housing structure. All this together, what are called zones, will be exposed to more risks”.

As a reminder, the level of drought in the Alpes-Maritimes was unprecedented in 2022. Direct consequence: home insurance is more and more expensive. And according to the head of this new insurance, the forecasts do not promise very well.

When we discuss with climatologists, we realize that in the coming years, with the recurrence of disasters and the greater frequency, all this will increase the costs. There is no magic, if the drought gets stronger, the materials become more and more affected, we can end up with a significant increase in insurance contracts and even higher standard deviations.

The study carried out by Leocare specifies in particular that the estimate for damages in connection with drought is calculated for per 43 billion euros in 2050 in France. 50 billion is calculated for floods, 46 billion for storms.

Was this article helpful to you? Note that you can follow Actu Nice in the My Actu room. With a single click, after registration, you will find all the news about your favorite cities and brands.